100 Meals Deduction 2025. Food and beverages were 100% deductible if purchased from. New rates for employee benefits, gifts, meals, lodging, and travel in 2025.

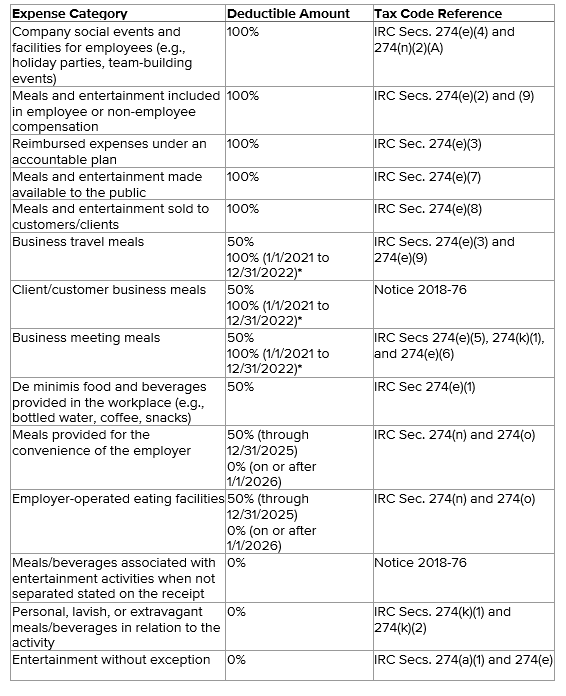

2025 meals and entertainment deduction. No deduction for meals provided for convenience of employer after 12/31/2025.

100 Meals Deduction 2025 Images References :

Source: lariqsarine.pages.dev

Source: lariqsarine.pages.dev

2025 Meals Deduction Binny Ursula, As part of the consolidated appropriations act signed into law on december 27, 2020, the deductibility of meals changed.

Source: www.youtube.com

Source: www.youtube.com

100 Meals Deduction , Home Office Deduction Child Tax Credit , Roth, Certain meals provided to employees may be 100% deductible.

![The [Temporary]100 IRS Meal Deduction YouTube The [Temporary]100 IRS Meal Deduction YouTube](https://i.ytimg.com/vi/tC5YGS17cms/maxresdefault.jpg) Source: www.youtube.com

Source: www.youtube.com

The [Temporary]100 IRS Meal Deduction YouTube, Meals at certain team building social, recreational, or entertainment outings available to all company.

Source: florryqdianemarie.pages.dev

Source: florryqdianemarie.pages.dev

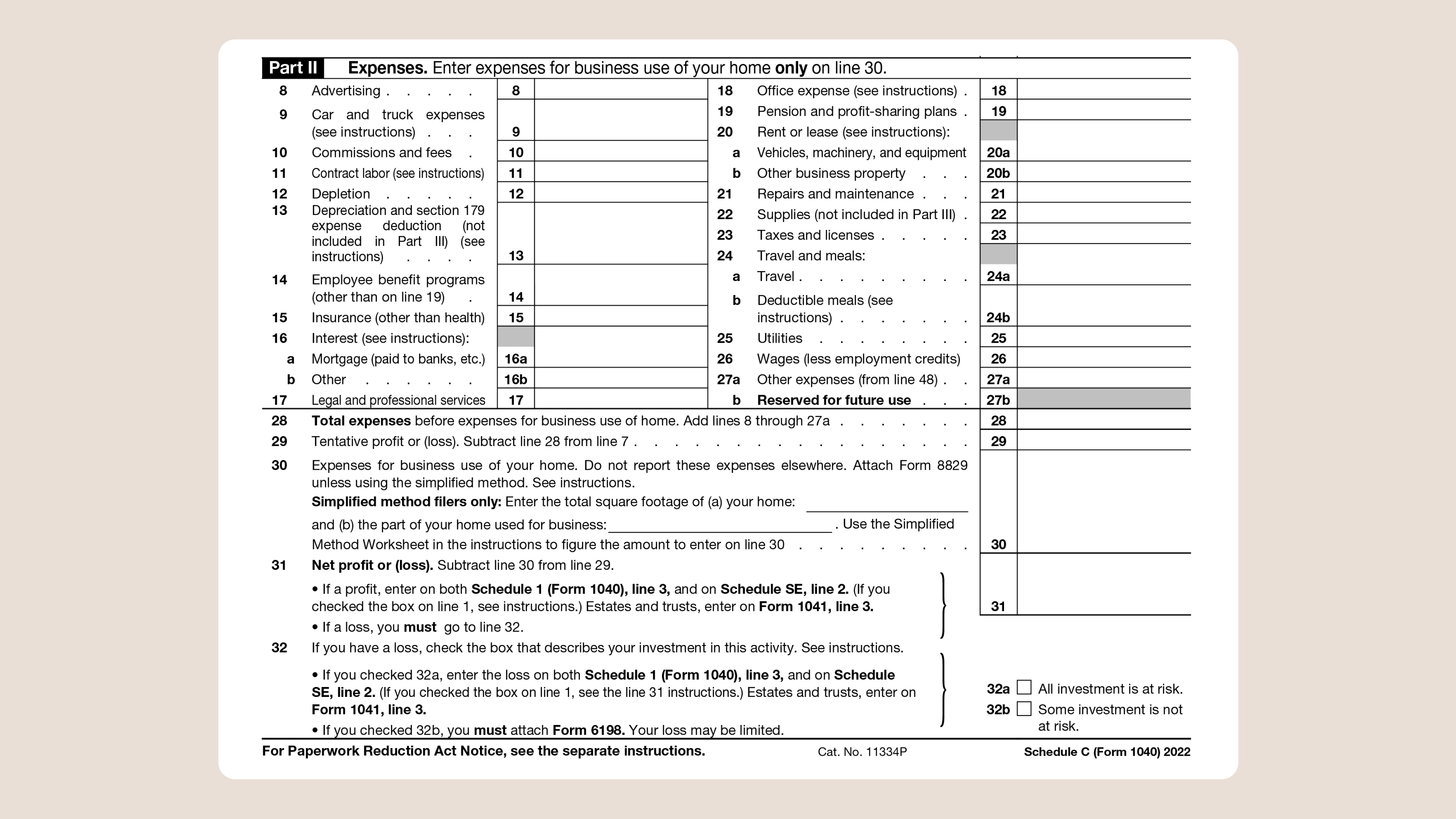

Schedule C Meals Deduction 2025 Chelsy Mufinella, You can also write off 50% of snacks and 100% of occasional meals provided to employees.

Source: shaycpa.com

Source: shaycpa.com

Meals and Entertainment Deduction Shay CPA, In addition, until december 31, 2025, you may deduct.

Source: alloysilverstein.com

Source: alloysilverstein.com

100 Deduction for Business Meals in 2021 and 2022 Alloy Silverstein, After 2025, expenses for the.

Source: alloysilverstein.com

Source: alloysilverstein.com

100 Deduction for Business Meals in 2021 and 2022 Alloy Silverstein, Effective january 1, 2026, new §274(o) provides that no deduction is allowed for any expense for a de.

Source: hailyqaundrea.pages.dev

Source: hailyqaundrea.pages.dev

Are Meals And Entertainment 100 Deductible In 2025 Mary Theresa, 2025 meals and entertainment deduction.

Source: www.youtube.com

Source: www.youtube.com

Business Meals 50 Deduction 100 Percent Deduction Tax Planning for, 50% deductible or 100% deductible.

Source: flyfin.tax

Source: flyfin.tax

Meals & Entertainment Deduction 2022 5 MustKnow Tips FlyFin, After december 31, 2025 there will be no deduction allowed for the following: